Here we are, Post Easter 2021, and still, not once have global financial markets been allowed to properly “clear” since the beginning of the 2007 GFC.

It’s just one bail out after another, every year, or in the case of recent months, weekly.

Last week’s largest Hedge Fund blow up since LTCM in 1998 barely sent a ripple through financial markets.

We’re guessing you might not know who Archegos was? It WAS an unhinged, Prime Broker funded, Over the Counter (OTC) derivative laden hedge fund investment gambling house.

And then, “poof”, it’s gone! The last players at the table torched another 10-20BILLION!

But hey, plenty more where that came from so why wouldn’t Financial markets just shrug at this?

In the US, only weeks after the US Biden administration put in place its latest $2Trillion “package”, the next $2trillion is already on deck, with promises of many more to come.

Right now, the US Fed alone injects 120BILLION per month in financial “stability stimulus”.

It’s not just the US, everyone is “in” on this money creation malarkey, check the Europeans in the chart below.

So, if everyone is in on it, and all currencies start to debase at an even faster pace (known as inflation), investors would be wise to reassess ways and means of preparing for potential knock on effects or “systemic wobbles”!

In past millennia one way to store value was investing in precious metals.

However, these days, precious metals are as under owned at any time in (just about) recorded history, RELATIVE TO investable financial assets.

This is why this post Easter 2021 note is all about gold.

The other reason, as you will see below, is normally we have to wait until the mid-year for the guys n gals at Incrementum to bring us the always incredible “In Gold We Trust” report but for some reason they’ve pre released some of their hard work!! Thanks.

We’re not sure whether our commentary to the charts below will be helpful but the pictures are great, enjoy.

This chart below is almost out of date, given the rate of TRILLION creations in recent weeks.

Grease the wheels with some money printing!

Who gives a sh!t about Silver anyway?

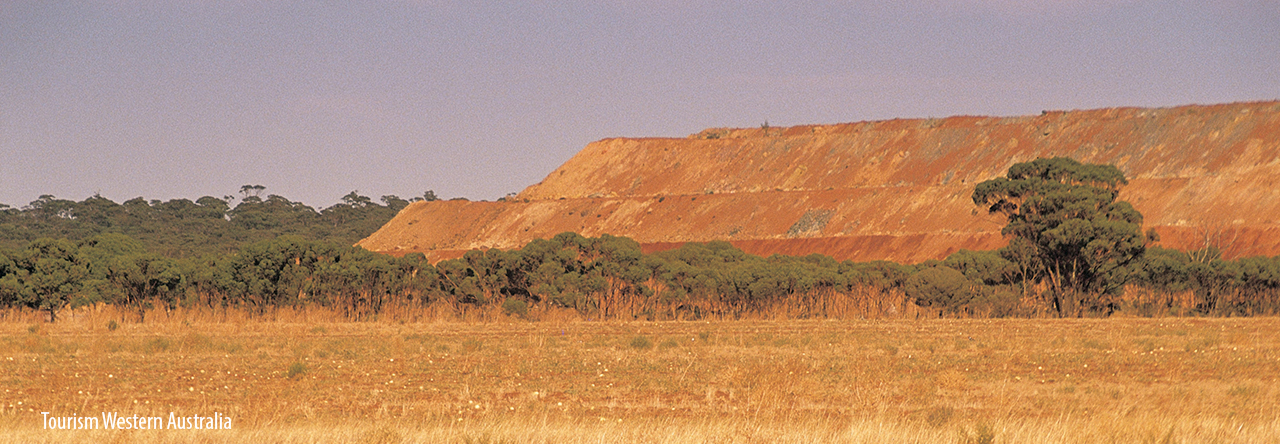

Miners looking good…………

Gold ETF’s have claims to real paper…….

Many financial market participants will never realise the meaning, or reasons, for their being so much derivative leverage in Precious Metals than “other” commodities as laid out in the chart below.

Some Know!

Peace!