The “inflation standoff” continues.

On one side, .gov, Central Banks and Central Bank cheerleaders, aka mainstream Financial media, selling, “if it’s happening it won’t be for long”! On the other side, consumers all over the world wondering how high, and for how long prices will continue rising.

As a consequence, a little over a week ago, markets had a couple of down bad days after The US Federal Reserve changed its language from “not even thinking about thinking about thinking about tapering or raising rates” to “thinking about thinking about raising rates” IN 2023!!

The (stock) market reaction to the threat of one less thinking about thinking of raising rates due to inflationary pressures was so bad that all hands were called to deck.

So, last week, we had the A-Team, The Plunge Protection Team and 16 Team Fed speakers from all walks of life, walk up and down the Freeway of “everything is actually fine, nothing to see here”.

What is most alarming about the US Biden administration calling in all of its most senior economic “advisors” at the same time the Fed rolls out all available mouthpieces is that this utter panic was caused by only two down days for stocks. Is the ‘bubble” so long in the tooth that two down days (modestly down) is considered a pop?

By the end of last week (see timeline below), the week ending the 25th of June, markets were back at ease, there will be no change to emergency stimulus and 0 rate hikes, for the foreseeable future! In the chart below, the green is equities, the flat line is Gold!

Success looks like this:

To further the theme of Central Bank policy reach, it’s nothing for the Bank of Japan to step up the bid for equity ETF’s. The fact that they stepped up to halt the slide two days before the US Fed intervention is a sure tell we’ll be looking for again. For now, we should be relieved that the BOJ purchase of ETF equities to “save” the market was only the first since April.

Regular readers of these pages need no reminder that the Central Banks, in our opinion, will do nothing about inflation because they can do nothing.

The events of the last 2 weeks have proven this. Now might be a good time to go back and reassess the sizing of one’s inflationary positioning in asset portfolios.

One might also want to re assess one’s “ESG blowback” portfolio, if you have one. Talk about two birds with one stone for Energy investors right now!!

But hey, this could all be transitionary, right? As far as oil is concerned OPEC could open the spigots wider, a deal could be done with Iran, don’t get too excited.

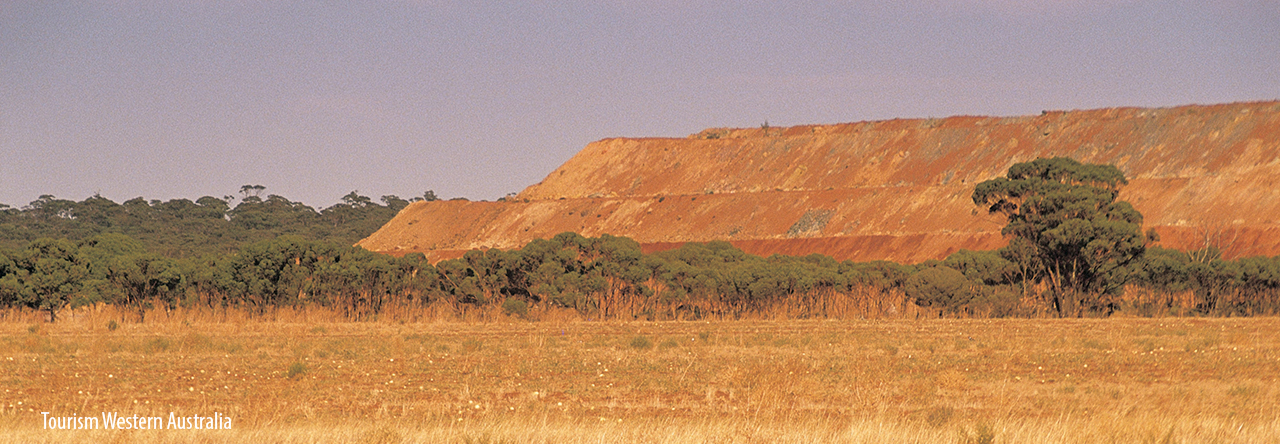

For the rest of this note, time to enjoy some pictures. We’ve said enough of this malarkey.

One more thing though, news out of China that they may be tapping into their enormous stockpiles of key commodities amidst price concerns may turn out to be the only transitionary aspect of this inflation bout.

Global markets are now in a position where the only thing that will alter the direction to inflation/stagflation will be the actual bursting of this bubble, the one thing we know Central Banks are hell bent on preventing.

Nothing like a safety net to draw in a bit of retail margin debt near a “peak”.

Couple of gems below from Jesse Felder.

We can only hope.

What bubble?

Anyway, let’s hope there is no bubble pop, and life just sustainably ticks on??

Speaking of “sustainability”, how does this look for a “budget” position?

The explanation of this chart below can be a little complex but it could be telling Central Banks, we’ve got enough money!! #Chockabloc!!

This one we included this as we just liked it.

Didn’t really like this next one but it does tell a story or two.

And this:

Yes, we know we’ve severely neglected Precious Metals in this note, more to come.

Peace.